One of the best parts of DeFi is the focus new financial protocols have on doing one thing perfectly. Some examples are Orca’s swapping, Solend’s lending, or Mango’s perps. They are outstanding products, but the power of using each product’s secret sauce sequentially still needs to be realized.

So what’s stopping someone from realizing the best alpha among all of these protocols? Well, to start, it’s tedious. It can take a while. Using one of these products is fine, but using all of them together can be challenging.

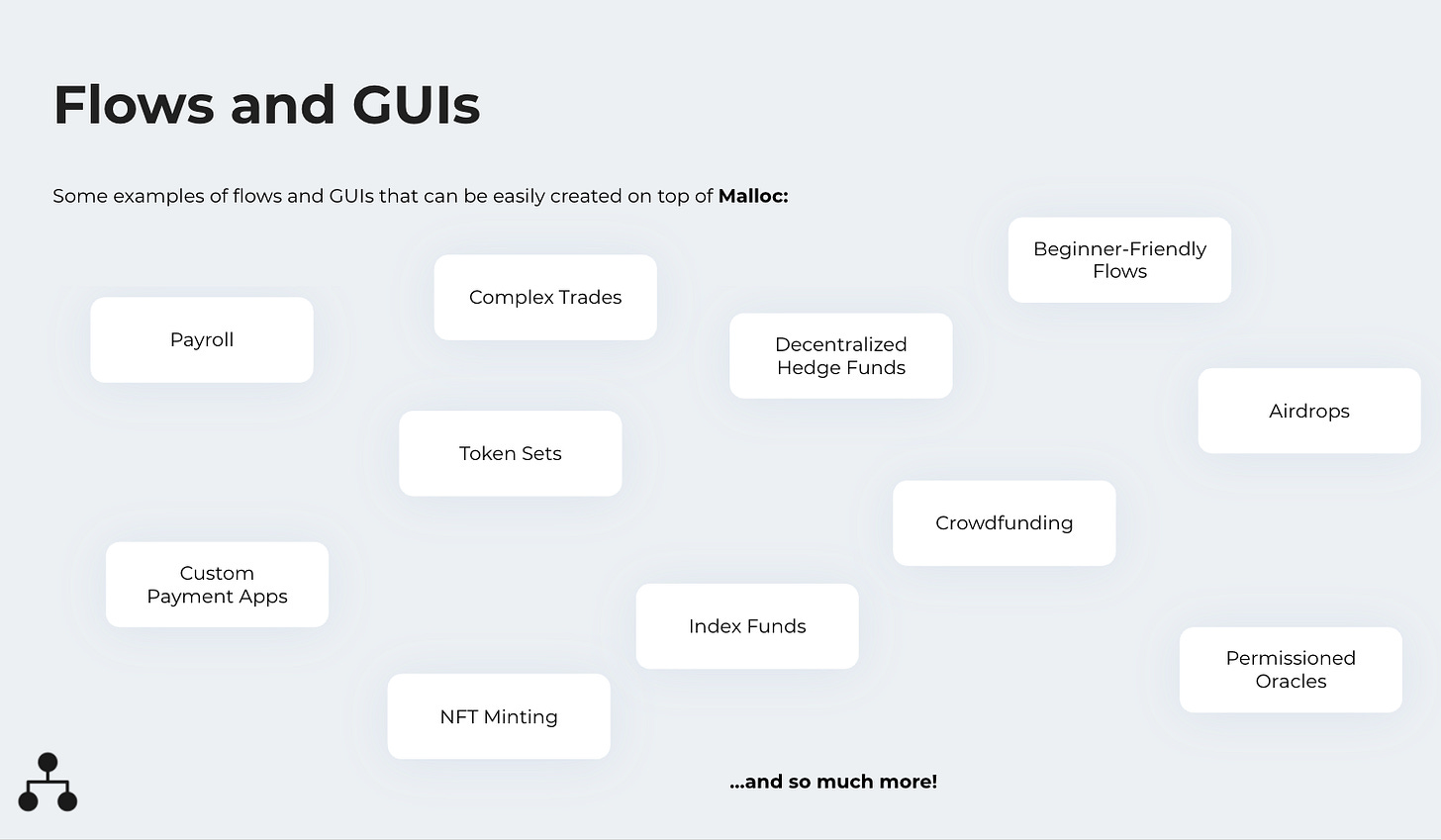

Malloc’s flows help with that.

So what is a flow? Simply put, a flow is a string of transactions to arbitrarily split any amount of money between contract calls.

Let’s take a look at an example alpha (not investment advice):

Provide Liquidity to RAY-SOL

Stake LP Tokens

Get Rewards

Lend out daily cash rewards on Solend

Sweet right? The issue is, DeFi's use cases are limited to 1 transaction (or set of transactions) unless people want to spend linearly increasing time configuring their finances.

With Malloc, you can create this flow in minutes in 2 different ways:

Use our no-code flowchart sandbox to quickly build and execute this flow, all within a few minutes.

Use our low-code language to quickly write this flow and integrate it into your project or business. Now anyone can call that flow with their own token accounts and balances.

The best part? If you’re a developer, since no smart contract code is written, no audit is needed! Deploy GUIs or integrate flows into your product in minutes, not months.

Malloc aims to help both DeFi users and developers, creating infrastructure critical to widespread adoption and growth.

Follow us on Twitter to stay updated and be the first few users of a new era focused on UX.

— The Malloc Team

@mallocprotocol

mallocprotocol@gmail.com

wagmi